Wave Accounting Review: Pros, Cons, Alternatives

If you do want live support, you’ll need to invest in an Advisor or paid service. Sign up for Wave and send your first invoice right away—it only takes a few minutes! With the Pro Plan you can also set up recurring payments, auto-reminders, and deposit requests to make sure you always get paid on time.

- However, both the free (Starter) and paid (Pro) plans offer basic features, such as invoicing, income and expense tracking, and payment processing.

- Wave earned high marks for general features, and it could have aced the criterion if users could use account numbers in the chart of accounts and import a chart of accounts.

- It’s also intuitive so you don’t need to be an accountant to use it successfully.

- It allows you to create and send unlimited bills and invoices, manage invoices on the go with Wave’s mobile app, and generate financial reports among others.

- It’s important to choose a product that your business won’t grow out of, as this will help you avoid tedious data transfers and learning curves.

- These solutions are integrated within your dashboard and you’ll access them both through your single Wave login.

Get the Reddit app

You’ll pay 2.9% plus $0.60 per transaction for Visa, Mastercard and Discover; 3.4% plus $0.60 per transaction for American Express; and 1% per transaction for ACH transfer from your client’s bank account. The platform’s design is intuitive, so it’s easy for anyone to set up and use. Hundreds of thousands of businesses of all sizes use Wave to pay their employees, take payments basics of forensic accounting from customers, collect cash from outlets, and accept payments online. In addition to creating invoices, Wave gives users the ability to create estimates for potential clients. Once those estimates are approved, they can easily be transformed into invoices with the click of a few buttons. Yes, Wave still offers a free plan, but it’s now limited to a single user.

Manage accounts receivable effortlessly

The sales and income tax features are evaluated across the other categories, so it has no separate video. Once an invoice is created, you can email it directly to your customer in the paid version. The free plan doesn’t let you do that, but it provides you with a link to your invoice so that you can include it in your own email.

Accept credit cards

It is a user-friendly, intuitive platform even for those with no prior accounting experience. As a free service, it is a good option for freelancers, entrepreneurs and small business owners who would like to keep their overhead low. Despite several limitations, Wave still has plenty to offer small businesses. It offers essential functionality that will help you pay bills, invoice customers, and track your expenses even in the free Starter plan. You’ll need to upgrade to the Pro plan for $16 per month if you want live customer support.

We believe everyone should be able to make financial decisions with confidence. Wave was designed specifically for small business owners like you – no CPA required. With our intuitive dashboard, you’ll be a money management pro in no time. Enable invoice payments by credit card for a pay-as-you-go fee as low as 2.9% + 60¢, and watch the money roll in. Be your own accountant, thanks to Wave’s automated features, low cost, and simple interface.

Even more ways to get paid: Bank payments

For example, the rate a freelance web developer charges may be different than that of a freelance graphic designer, because each freelancer specializes in a different area. I look at the dashboard and know how many invoices https://www.accountingcoaching.online/recording-depreciation-expense-for-a-partial-year/ are on the way, when they should be paid, and the average time it takes someone to pay. Xero lets you add unlimited users in all plan tiers and, similar to QuickBooks Online, can grow alongside your business.

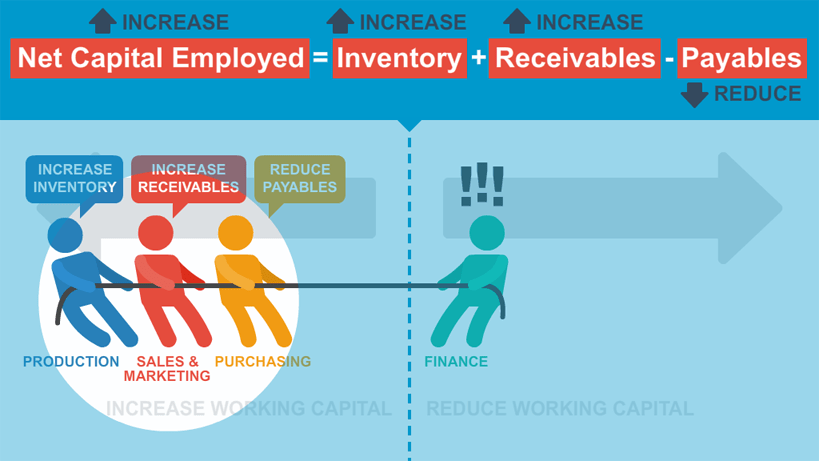

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units. You can access personalized support through the Wave Advisor program where you can get coaching and year-round advice from a Wave expert. These support services are expensive for most small businesses, and we can’t fully recommend them to you unless you have a budget to spare. Your only support is through an automated chatbot or by browsing through self-help resources. If you need access to email and live chat support, you must purchase an add-on in the free plan or upgrade to the paid version.

As seen in the chart above, Wave beats QuickBooks Online and Zoho Books in pricing and ease of use. However, Wave’s two competitors have notable advantages in terms of features, like banking, A/P and A/R management, inventory, and project accounting. If you have a question or issue, you can browse the help center or reach out to Mave, the automated chatbot.

As a more modern platform, Wave has a simpler and easier-to-navigate user interface (UI) while QuickBooks offers an array of features and tools that require a significant learning curve to navigate. Users are not able to assign estimates to projects or track income and expenses by project. The software must have features that allow users to set sales tax rates, apply them to invoices, and https://www.simple-accounting.org/ enable users to pay sales tax liability. Wave allows you to add sales taxes to invoices, bills, estimates, and expense and income transactions. Whenever you enter a transaction with a sales tax, it records the amount automatically in the sales tax liability account. Depending on your subscription, you can snap a photo of your expense receipt and upload it to Wave through the mobile app.

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use.

Intuitive, customizable invoicing capabilities compete with those of more robust accounting solutions. In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users. This makes Wave unable to handle taxes in countries like Australia where prices must be quoted inclusive of all taxes, such as GST.

Wave keeps up to date records so you’ll always have the info you need for filing – or sharing with your accountant. Automate the most tedious parts of bookkeeping and get more time for what you love. With this release, we’re waving bye to bugs and hello to stability improvements.

ZipBooks’ free plan stands out for its Square and PayPal payment integrations, a feature some companies only provide in paid plans or as an add-on. This is especially nice for small-business owners who accept payment in person with a Square card reader. Wave is an up-and-coming contender in invoicing and payments software for small businesses. It’s primarily devoted to freelancers and small single-owner businesses, offering a single free plan that lets you send invoices, track expenses, receive online payments and run financial reports.